I sometimes come across a property that seems perfect, the right location and tenant, it is the definition of strength and quality. These are the properties that tick all the boxes and scream out “Buy Me!”.

In Engines of Wealth we dedicate an entire chapter to defining the characteristics of a great retail shop, so you can recognise them when you see it. It could be the café positioned opposite Bondi Beach or a newsagency in Flinders Street station. The best sign to indicate a shops’ quality is a national brand, such as Bakers Delight, Boost, IGA, Subway, Coffee Club or if your pockets are deep enough Bunnings.

The above businesses all make great tenants with an exceptional ability to pay their rent, offering you the landlord security and safety. The question is what is the price to pay for such quality? No matter how attractive they seem I typically find these “perfect” shops to be too expensive, with capitalisation rates of 6% or less.

I am regularly asked the question “Phil, at what capitalisation rate do you see quality, how low are you prepared to go?” and also “What are the risks of going too far?”. Those who have read Engines of Wealth will know that the simple mathematic formula I use to guide my purchasing decisions and value properties should deliver the investor a 7.5% rate of return. With Australian interest rates at low levels, this return offers the buyer a solid profit and a reasonable safety margin against interest rates that will one day edge upwards.

I use a 7.5% return as the foundation for a strong investment, I have been known to increase my price when I believe the shop has something special. In short, I am willing to pay a premium for quality, yielding a lower initial return. I don’t think there is a better example to use to demonstrate quality than a Bunnings Warehouse, but just how much is that quality worth?

Let me expand on my thought process to understand the implication of this question. At the end of 2018, I can secure a bank loan to buy a shop for 4.5-4.6%, so with returns of 7.5% and above this offers a reasonable safety margin for profit. Paying higher prices and achieving lower returns of 7% or even 6.5% for quality properties is something I would consider. However at 6.5% I remind myself of a golden rule “we invest to make money”, we don’t invest to drive past the property each week and feel proud we own it.

The shops on realcommercial.com.au with national chain tenants are often listed with capitalisation rates of 5.0 – 6.0% return. In some cases these properties have development potential from a rezoning aspect that justifies the price point, but in most other cases I’m left shaking my head. When I see properties selling for 5.0% – 6.0% returns I am never disappointed I missed out on the sale, at that price I’d rather walk away. I believe the people that buy at such low returns are not impacted by banks and interest rates, they have the cash in the bank and want to convert it into a strong, resilient income stream. After all if you have the money, 5% in a strong shop is still better than 2.5% in a bank term deposit. Like most investors, I do not have this luxury and borrow money to secure my shop, hence need to ensure my returns stay well above the bank interest rate.

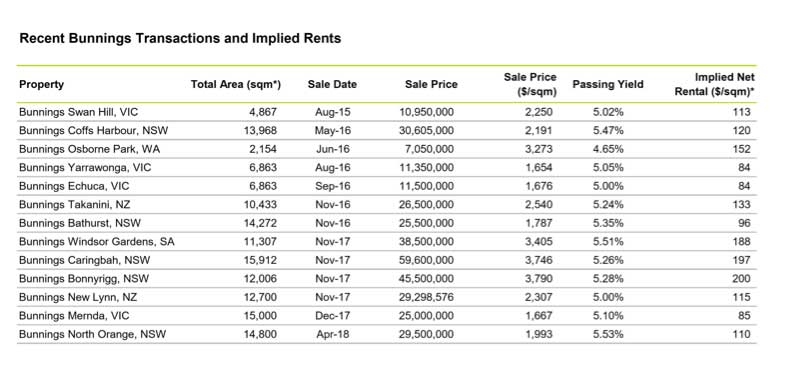

So back to our Bunnings example, what price is quality worth? I recently came across a Bunnings for sale in Katoomba in the Blue Mountains, normally I do not see value in NSW, but given this is in a growing regional area I was interested. The energetic agent shared some recent Bunnings Warehouse sales statistics to help encourage me that the Katoomba property was good value. I was truly amazed at these sales results and have attached them below to emphasise what others believe is the price for a quality Bunnings Warehouse.

Upon first look a few things jump out, like what was the WA buyer in Osborne Park thinking at a 4.65% return? When you get your head around the 5-5.5% returns, next is the sheer size of some of these transactions – $25M, $30M and Caringbah at a touch under $60M. Wow these transactions are certainly the big end of town and this is why I don’t own a Bunnings, but we can always dream of having this much money to deploy.

If you have this sort of money in the bank, then getting a 5.5% return, plus capital growth of 2 – 3% results in a decent 8% return which is tax effective after depreciation. For the rest of us that rely on bank funding to fuel our investments then these capitalisation rates should be avoided. My advice is when an agent offers “similar sales figures”, remember they are trying to convince you that everyone is getting this return, so you should be happy as well. In my experience I strive to be a better investor than most and will not be influenced by ‘herd mentality’. There is no such thing as safety of the pack when you are investing, you hunt alone and every shop is different – even with a national brand on the door.

When looking at a property that looks “perfect”, each investor must understand their personal situation and not over stretch your ability to meet mortgage repayments. I like the 7.5% valuation as it provides a good safety margin and I believe there is a natural level in the economy in which it would be difficult for interest rates to exceed. Aggressively acquiring quality properties at capitalisation rates below 6.0% is only a good idea if you are paying cash.

I sometimes try to “separate from the pack” and pursue the prize of a café on the beach or a Woolworths, but one thing always holds true, I cannot predict interest rate movements so the Cost of Quality is always above a 6.5% rate of return. Which means for now the dream of owning one of these big fish must wait for the market to return to “buyers conditions”.